Hope you are well, I think we are heading to a total stop in US

This piece is worth your attention.

FYI... Not to be used but for your interest.

Guys,

I wanted to share for any input. I’ve been watching what is going on in markets and my conclusion was that Risk Parity has blown up and Citadel and Millennium are in deep trouble. I just received a call from an old GS friend who now runs a large part of a Japanese bank balance sheet in the US and he was highly agitated...

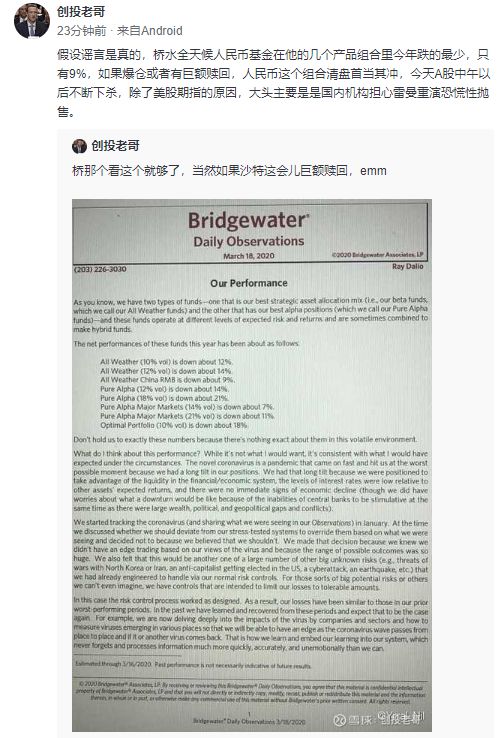

His observation is that Bridgewater has faced massive redemptions from Saudi and others and that is what is caused some of the more dramatic moves last week (gold, bonds, equities and FX). He thinks AQR and 2 Sigma are in the same boat. There is massive forced liquidation of risk parity. All of them run leverage in the strategy, sometimes significant. Sovereign wealth, he thinks, is running for the hills as are others.

As you all know, I think Bridgewater goes under for reason not involving this but the exposure of massive fraud but this will force it.

My friend explained that due to the Volker rules, now that vol has risen, we has to cut risk limits by 80% in many areas – to put it in perspective his Dollar Mex position limit has gone from 200m to 12m. Thus, just when he was supposed to prove liquidity, he has to reduce it. His hands are tied. Even worse, he has to hedge counterparty risk with corp borrowers and that is adding to the tail spin of selling. There is no liquidity from the banks.

The same VAR issue, he claims, is hitting Citadel and Millennium but with a twist. He, along with all the banks, is jacking up lending rates to counterparties from Libor +35 to Libor +90 and he has a $1.5trn balance sheet. The funding stress is forcing banks to reduce lending risk. The issue is that the funding stress is coming from Citadel and Millennium it seems. They rely on repo but via the banks but the transmission mechanism is broken (regulation). It appears that Bernanke probably called Powell and asked him to flood with liquidity at repo but instead of $500bn being drawn, only $78 was drawn. The banks don’t need the cash and don’t want to lend to counterparties. And there in lies the problem – a full credit crunch.

With rates going up, all the relative value trades have blown up. Nothing works any more as they were making 12bps in illiquid stuff on massive leverage (off the runs, etc). As funding goes up they instantly go wildly unprofitable and are stuck either begging for repo funding or having to unwind and realize massive losses. There is no funding. This is big trouble.

These guys are short vol (VAR), short liquidity and short rates. The perfect fucking storm.

Then on top of that, my friend who was almost yelling to me about it, says he cannot take any risk and therefore cannot provide liquidity. His hands are tied.

COVID makes it even worse and liquidity is going to massively dry up next week and for the next few weeks. You see under Series 24 of FINRA, a trader cannot make markets from home. It is illegal. So everyone is getting sent home but the traders. The problem is the traders are now falling ill – JPM and CS are the two I’ve heard thus far. They will have to go home and each day more do, or decide they want to, the lower liquidity gets. No one can make markets.

Also, in the corp credit markets things are equally fucked up. Credit, due to the liquidity issues, has stopped trading. That is causing IG etc to blow out. When banks lend to corps, a separate desk (CVA or CPM desk) shorts the stock or buys the CDS etc as a hedge (regulations again) and if the loan is still on the books (they are not allowed to own the bonds but can lend to counterparties, bizarrely) they continues to do that as stocks fall or CDS widens. Essentially, they are short gamma, creating a lob sided market. Everyone is a seller and no one is a buyer. The banks have made money on the hedges while the debt markets get worse.

This is causing the equity value of many firms such as Haliburton, to fall below the debt levels. Whether these borrowers have cash on balance sheet or not is irrelevant because of the falling equity value in this market and from the CVA hedging. That is causing spreads to blow out and it will cause downgrades, thus creating a doom loop.

So, we have a total shit storm if vol stays here for any period of time. I do not see vol falling yet and that is going to cause a really big issue with Citadel, Millennium, all the risk parity unwinds, all the risker credit that is being shorted for hedging and the repo that no one wants in the banks but their counterparties desperately needs. Every day this situation continues, the more dangerous it is going to get....

We have a big fucking margin call under way.

In my friends opinion, the only way to stop this is to remove the Volker rule under the emergency powers act ( to allow banks to provide liquidity), the Fed to cut to zero and for them to buy corporate bonds. All the banks have been talking to FINRA and they have said go to the government. Problem is Jamie Dimon is in bed. They need him to run the US Treasury as he is the only person who understands all of this and can navigate it through the politics.

This is likely the fix that needs to happen. What happens to Citadel, Millennium, Bridgewater, AQR, 2 Sigma and the corp bond market until they pull that trigger, I have no idea.I thought you’d all be interested.

先向各位问声好。我想美国就要崩了。而这篇文章值得你们看看……

我想分享一些意见。我一直在观察市场的动向,我的结论是风险平价已被打破,强如Citadel和Millennium也陷入了麻烦。我刚接到高盛一位老朋友的电话,他现在在美国负责打理一家日本银行,他现在都快崩溃了……

他注意到桥水基金正面临着来自沙特等国的大规模赎回。而这正是导致该基金上周黄金、债券、股票和外汇等仓位出现一些更剧烈波动的原因。他认为AQR和2 Sigma比桥水好不到哪里去,大规模仓位被强平。它们之前在投资中都大量使用了杠杆,虽然有时杠杆非常重要,但等灾难来临了,它们背后的主权财富基金就像其他人一样,正在逃之夭夭。

大家都知道,我认为桥水崩盘的理由不在于此,桥水还有大规模欺诈行为。

我的朋友解释说,由于沃尔克规则,现在波动率上升了,我们不得不在许多领域实行80%的风险限制——比如美元头寸限制已从2亿美元提升到1200万美元。因此当一个人需要流动性的时候,他却不得不减少风险资产的头寸。这样以来其实他手脚已被束缚。更糟的是,他还得与公司借款人对冲交易对手风险,这加剧了抛售,而银行由于担忧风险,又不愿充作对手方提供流动性支持。

他认为VAR是另一个巨大隐患,Citadel和Millennium这两家基金正受此影响,但具体情况有所不同。它们都参与银行间市场回购交易,但如今贷款利率已经从Libor+35上调至Libor+90,资产负债表规模也已经达到1.5万亿美元。基金公司的资金压力正迫使银行降低贷款风险。问题在于,Citadel和Millennium高度依赖回购市场,但其实又绕开了银行,导致整个监管传导机制被打破。这就好像伯南克打电话给鲍威尔,要求他在回购时注入大量流动性,但他只提取了78美元,而不是5000亿美元。银行不需要现金,也不想贷款给交易对手方。问题就在于此——一场全面的信贷紧缩。

随着回购市场贷款利率的上升,所有的相对价值交易都泡汤了。他们利用巨大的杠杆在非流动性资产上赚取12个基点也没什么意义。随着融资的增加,它们很快就会变得无利可图,要么苦苦哀求回购融资,要么提取巨额亏损。资金流出将不可避免,这是个大麻烦。

现在很多人做空风险资产、做空流动性、做空利率,然后这一切都乱套了。

最重要的是,我朋友说他因为不能承担任何风险,而不能提供流动性。当然他也是身不由己。

疫情正让情况变得更糟,流动性将在下周乃至未来几周大量枯竭。你可以在FINRA的24系列中看到,交易者不能在国内做市。它是非法的。所以每个人都被送回家,除了交易员。问题是,交易员们现在也有被感染的——到目前为止,我只听说过摩根大通和花旗这两家公司。他们将不得不回家,每天做更多的事,或决定自己想做的事,流动性会变得更低。没有人能做市。

同样,在公司信贷市场中,情况同样令人发指。由于流动性问题,信贷已停止交易,这导致投资级债券等崩掉。

当银行贷款给公司时,一个单独的柜台(CVA或CPM柜台)做空股票或购买CDS等作为对冲(再次进行监管),如果贷款仍在账簿上(不允许他们拥有债券,但可以借给交易对手),随着股票下跌或CDS扩大,他们继续这样做。从本质上讲,它们是短Gamma值,从而形成了单边市场。 每个人都是卖方,没有人是买方。 银行在对冲中赚钱,而债务市场却恶化了。

这导致许多公司的股票价值跌至债务水平以下,比如Haliburton。公司资产负债表上是否有充足现金都不重要了,因为这个市场的股票不断下跌,以及来自量化交易的对冲。这将导致利差扩大,并将导致评级下调,从而形成一个恶性循环。

所以,如果这样的风险资产规模继续持续一段时间,我们必将面临一场巨大的风暴。迄今为止我还没有看到风险的下降,这将导致Citadel、Millennium的风险天秤被打破。卖空对冲的人继续考验着信贷风险,而在回购市场银行又想置身事外,但交易对手方迫切需要银行介入提供流动性。这种情况每持续一天,就会变得越危险……

追加保证金通知一天天的骚扰个不停。

在我朋友看来,阻止这种情况发生的唯一办法是取消《紧急权力法案》(emergency powers act)下的沃尔克规则(允许银行提供流动性),美联储将利率降至零,并允许银行购买公司债券。所有的银行都和FINRA谈过,他们说去求助政府。问题是,Jamie Dimon正在睡觉。他们需要Jamie Dimon来管理美国财政部,因为他是唯一了解这一切,并能在政治圈中游刃有余的人。

在不了解触发因素之前,桥水基金、Citadel基金,Millennium基金AQR,2 Sigma和公司债券市场会发生什么,只有天知道。

“假设谣言是真的,桥水全天候人民币基金在他的几个产品组合里今年跌的最少,只有9%,如果爆仓或者有巨额赎回,人民币这个组合清盘首当其冲,今天A股中午以后不断下杀,除了美股期指的原因,大头主要是是国内机构担心雷曼重演恐慌性抛售。”

动荡市场下,这些机构能否为他们守住辛苦积攒下来的财富呢?而经历过美国金融危机的千禧一代,对股票投资还会有信心吗?

当下美国面临的问题可能比我们想象的要严重的多,今年或许我们还要一起见证更多的历史,但在暴风雨面前,作为深入参与投资的我们更需要保持理性睿智,冷静思考。股市震荡,大家做好风险对冲和资产配置,莫要被过度影响生活,富途资讯与您同在!

评论