摘要

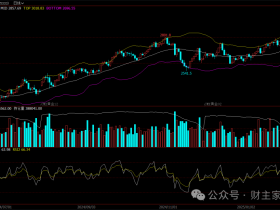

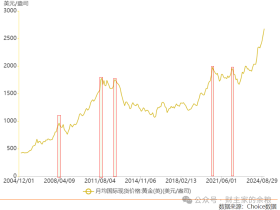

The election and the Fed rate hike have stolen the limelight in the precious metals market. With gold (NYSEARCA:GLD) price sharply declining post-election, the majority of people are diverting all their attention on how the stronger dollar, high possibility of December rate hike from the Federal Reserve and President Trump's robust economic policies, will put downward pressure on gold.

Meanwhile, some market participants have been asking questions regarding how three prominent global events can potentially impact future gold prices, namely:

1) Record gold purchase by Central Bank of Russia,

2) Potential impact of India's demonetization move, and

3) China's decision to tighten gold import.

My thoughts regarding these events are as follows:

1、Central Bank of Russia buys gold at record pace

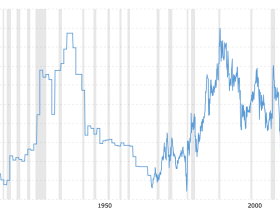

Russia has bought about 13 million ounces of gold in October - highest monthly addition to its official monetary reserve since 1998, as reported by goldcore.com.

Among the more interesting "theories" behind this record purchase I've heard was that Russia was buying more gold last month as a hedge against a potential Hillary victory during the election. The Obama administration has not been kind to Russia in the past eight years, and Russia expects more of the same treatment from Hillary. With Trump emerging victorious, some people are now worried that Russia would significantly reduce its purchases, or even sell some of its reserves.

In my opinion, it is highly unlikely that Russia would sell its gold reserves. The country has spent the past decade building its gold reserve in order to protect its economy from a global financial crisis, as well as to diversify from the flawed US dollar - the current world reserve currency. The Obama administration's sanctions on Russia have certainly persuaded it to buy more gold.

It is very possible that Russia would reduce its purchases in the near future. After all, it has been buying so much in the past month. This will be bearish for gold, but I expect Russia to increase its buying habits again should gold prices decline significantly, in order to take advantage of lower prices to continue accumulating its reserve.

2、Potential impact of India's demonetization move

On the 8th of November, Indian Prime Minister Narendra Modi shocked Indians in an announcement that the current 1,000 and 500 Indian rupee notes would be demonetized, and that the old notes must be exchanged at banks for newly redesigned notes.

The intention of this move, according to the government, is "to break the grip of corruption and black money". The Indian government is trying to mitigate corruption by outlawing high-denomination banknotes.

The move has thrown the Indian economy into chaos since India remains to be a cash-based economy. Many Indians do not have bank accounts, and much less 'plastic money' in the form of credit cards and digital currency. By removing such a significant percentage of currency in circulation, part of the economy has come to a complete standstill. People are busy queueing up in front of banks to change for newly designed banknotes, wasting their work hours in the process.

Unsurprisingly, some black money found its way to gold, and there currently exist rumors that the Indian government may curb gold imports to prevent more black money being associated with gold purchases. As the world's largest gold consumer and importer, some market participants are worried that an import ban by the Indian government would have a negative impact on gold prices.

In my opinion, import restrictions would struggle to achieve their objective. Gold prices may drop after the headlines come out. However, its effect would only last for a short while. Gold will still find its way into India through smuggling or other unofficial channels.

Gold bull should worry about the impact that demonetization has on Indian's economy. As people are busy queueing in front of banks instead of accomplishing productive work, their income has decreased. This would result in a drag on genuine Indian gold demands. I am more concerned about Indians reducing their gold purchases due to a weaker economy than rumors regarding the possibility of import restrictions imposed by the government.

3、China tightens gold imports

While gold import restrictions were still rumors in India, China has decided to strike first. The FT reported that China has tightened the gold import quota to curb the dollar outflow. For those who can't access FT, you may read the article on zerohedge.com.

According to the report, "... some banks with licenses have recently had difficulty in obtaining approval to import gold, they said - a move tied to China's attempts to stop a weakening renminbi by tightening the outflow of dollars, the banks added."

In addition, the report suggested

"...If the restrictions on imports are sustained, this could raise questions about China's motives to open its gold market to international traders."

Unfortunately, it did not provide further information regarding future policy decisions by the Chinese government.

I felt that this is likely noise for the current gold market. Any impact from this round of import tightening has probably been reflected on current gold prices. Unless the capital outflow is out of control, I do not believe that the Chinese government will decide to significantly tighten its policy on gold imports.

A U-turn by the Chinese government's decision to open up its gold market as FT suggested is unlikely; opening up its economy has been beneficial to the Chinese society, and there is no reason for it to change it now - closing up its gold market will send a very strong signal to the world saying that "something is wrong with our policy decision, and our economy."

Conclusion

All of the mentioned events have occurred last month, and it is no coincidence that gold prices have dropped sharply in November.

Moving forward, I think it's reasonable to expect Russia to buy less gold in the immediate future, given the amount it has bought last month.

Over the next few months, India will probably import less due to the disruption of the economy. Over the longer term, India is actually one of the reasons why I'm bullish about gold. Gold is a symbol of wealth, prosperity and status in India, yet many people in India are so poor that they remain to live hand to mouth. As India's economy grows and improves, I expect its gold demand to significantly increase.

In terms of China, we'll have to wait and see what steps Chinese government decides to take; but I think its impact on gold demands, should they decide to further restrict gold imports, will be less significant compared to before. On the other hand, in the case it decides to relax these restrictions, the formerly suppressed demand will return, and we can thus expect imports to be higher.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I own physical gold.

原文地址:https://seekingalpha.com/article/4028386-gold-russia-india-china

评论